When it comes to home loans, an offset mortgage offers a unique way to save money on interest. By linking your savings and current accounts to your mortgage, you can offset the balance of your savings against your loan, reducing the interest you pay.

This can help lower your overall mortgage term or monthly payments, providing you with more flexibility. Offset mortgages are becoming increasingly popular in markets like the UAE, where firms such as Sire Finance specialize in guiding clients through the process, offering expert advice on how to make this financial strategy work for you.

Ready to learn more? Keep reading to find out how an offset mortgage can help you save in both the UAE’s thriving property market and the global financial landscape.

How Does an Offset Mortgage Work?

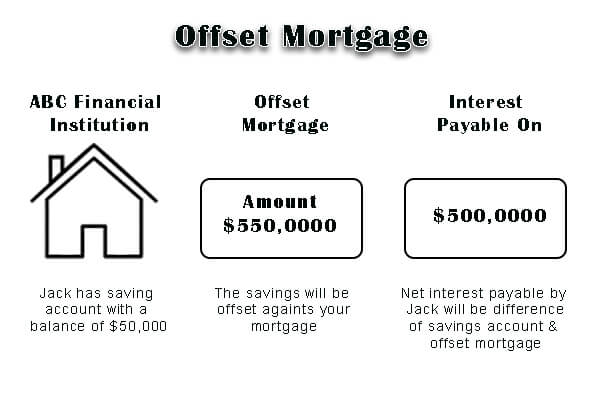

An offset mortgage works by using the balance in your linked accounts—typically savings or current accounts—to reduce the mortgage balance that is being charged interest. For example, if you have a mortgage of AED 500,000 and AED 50,000 in savings, you only pay interest on AED 450,000. This can lead to significant savings over time.

Example of an Offset Mortgage

Consider this scenario: You have a mortgage of AED 1,000,000 and savings of AED 200,000. The interest is calculated only on AED 800,000 instead of the full AED 1,000,000, which can significantly reduce the total amount of interest paid over the life of the loan.

In a growing market like the UAE, this can result in substantial long-term savings, helping homeowners pay off their mortgages faster while maintaining easy access to their savings.

What Are the Benefits of an Offset Mortgage?

The main benefits of an offset mortgage include reduced interest payments, greater flexibility, and the ability to access your savings at any time. It also helps you pay off your mortgage quicker without changing your monthly repayment amount.

In markets like the UAE, where the real estate sector can be volatile, this flexibility offers peace of mind for homeowners and investors alike.

What Are the Downsides of an Offset Mortgage?

While offset mortgages offer great benefits, they also come with some potential downsides. These include higher interest rates compared to standard mortgages, and the necessity of maintaining a higher level of savings to make the offset significant.

Additionally, if your savings are low, the offset may not provide as much of a financial advantage, making it less ideal for certain individuals or households in the UAE and beyond.

Who Can Benefit from an Offset Mortgage?

Offset mortgages are best suited for individuals who have a substantial amount of savings and want to reduce their mortgage interest payments. They are particularly beneficial for high-income earners or those who receive lump sum payments.

In the UAE’s fast-paced financial market, offset mortgages can be a great option for those looking to reduce debt while maximizing their savings potential.

Things to Consider Before Getting an Offset Mortgage

Before deciding to opt for an offset mortgage, there are several important factors to consider. These factors will not only help you understand if this type of mortgage is the right fit for you but also ensure you’re making an informed decision based on your unique financial situation.

1. Interest Rates

Offset mortgages typically come with slightly higher interest rates compared to traditional fixed-rate or variable-rate mortgages. While the interest rate might be higher, the overall cost could still be lower in the long run due to the interest savings from offsetting your savings.

It’s important to compare these higher rates with potential savings on interest payments to understand if the trade-off is worth it.

2. Your Savings Balance

The effectiveness of an offset mortgage relies heavily on the balance of your linked savings and current accounts. The more money you have in your savings, the greater the offset and the more interest you can save.

However, if your savings are minimal, the benefit of an offset mortgage could be reduced. Therefore, it’s essential to assess your ability to consistently maintain a healthy savings balance. If you’re unable to keep a significant amount in your savings account, the offset benefit may not be as substantial as you anticipate.

3. Long-Term Financial Goals

An offset mortgage is most beneficial if you plan to keep your savings in the account for the long term. If you’re planning to dip into your savings regularly or anticipate large withdrawals, an offset mortgage may not provide the financial advantage you’re hoping for.

Consider your long-term financial goals and evaluate whether this product aligns with your future plans, especially when thinking about your retirement, buying another property, or funding your children’s education.

4. Ability to Maintain the Required Savings

Offset mortgages often require you to keep a certain amount of money in your linked accounts to maintain the mortgage’s benefits. If your savings fluctuate or if you don’t have a substantial amount of savings, the offset mortgage may not work as effectively.

Before signing up, evaluate whether you have the discipline and financial situation to keep the required amount in your savings account consistently.

5. Tax Implications

In some jurisdictions, there may be tax considerations when using an offset mortgage. The savings in your linked account are still considered your money, and the interest savings may not always be as advantageous as they seem when accounting for tax liabilities.

It’s important to consult with a tax advisor to understand how your savings and mortgage offset will impact your overall tax situation.

6. Flexibility and Access to Savings

One of the key benefits of an offset mortgage is the flexibility it provides—you can access your savings when you need them. However, it’s crucial to understand that if you frequently access your savings or need to withdraw large amounts, the benefit of the offset will diminish.

Consider whether you need the flexibility to dip into your savings or if you can keep the funds locked away for the long term.

7. Overall Financial Situation

Lastly, it’s important to assess your overall financial health before opting for an offset mortgage. If your finances are already stretched thin, taking on a mortgage with higher interest rates could put undue strain on your budget.

Ensure that the offset mortgage is in line with your broader financial plans, including debt management, savings goals, and emergency funds.

Making the Right Choice: Why You Should Consider an Offset Mortgage with Sire Finance

An offset mortgage can be an excellent option for homeowners looking to save on interest and pay off their mortgage faster. However, it’s crucial to carefully evaluate your personal finances, savings, and goals.

Partnering with a financial consulting firm like Sire Finance ensures you get expert advice tailored to the UAE’s unique economic landscape and global financial trends.

Whether you are looking for more flexible terms or better savings, Sire Finance can help you navigate the complexities of offset mortgages and secure the best deal.